How do you calculate min monthly rental income?

The calculator works out the rental income required to meet Landbay's minimum ICR, based on the requested loan amount and product's stress rate.

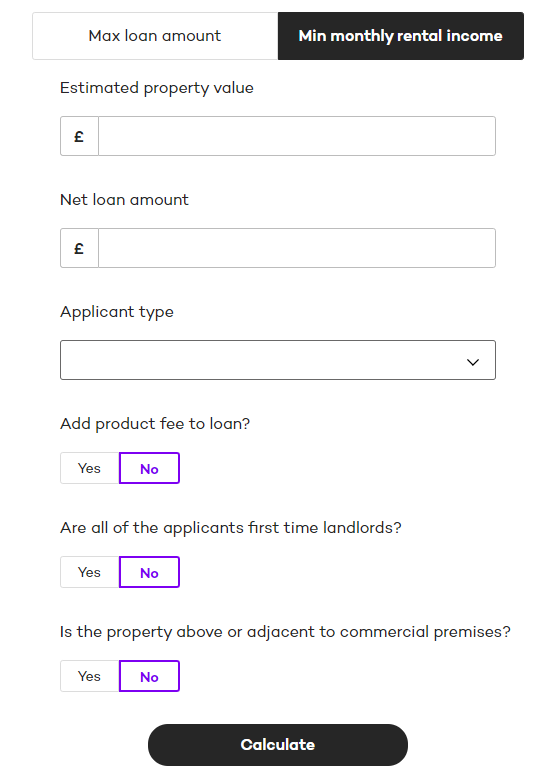

- Property value is checked against the minimum for the product

- Loan amount is checked against the minimums and maximums for the product

- LTV is calculated:

- Loan amount / Property value

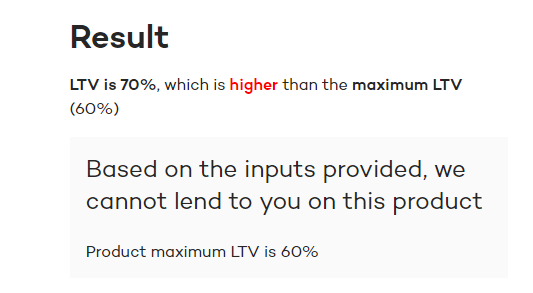

- LTV is checked against the maximum LTV based on the product and Landbay’s criteria - below is an example where the LTV is too high for the selected product

- If product fee is added to loan, gross loan amount is calculated as max possible loan + product fee, otherwise it is just the max possible loan

-

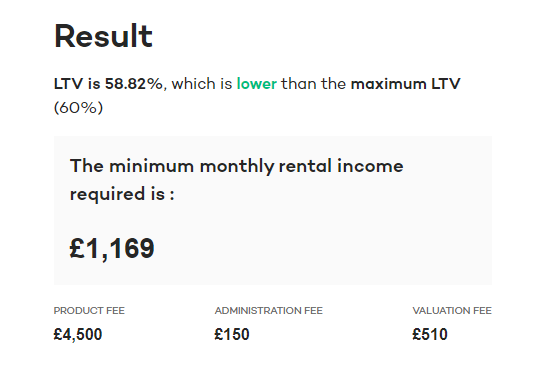

- (Gross loan amount * minimum ICR * stress rate) / 12

Minimum monthly rental income is calculated:

Minimum monthly rental income is calculated:

- (Gross loan amount * minimum ICR * stress rate) / 12